What Are Forward and Futures Contracts?

Essentially, forward and futures contracts are agreements that allow traders, investors, and commodity producers to speculate on the future price of an asset. These contracts function as a two-party commitment that enables the trading of an instrument on a future date (expiration date), at a price agreed upon at the moment the contract is created.

The underlying financial instrument of a forward or futures contract can be any asset, such as equity, a commodity, a currency, an interest payment or even a bond.

However, unlike forward contracts, the futures contracts are standardized from a contract perspective (as legal agreements) and are traded on specific venues (futures contracts exchanges). Therefore, futures contracts are subject to a particular set of rules, which may include, for instance, the size of the contracts and the daily interest rates. In many cases, the execution of futures contracts is guaranteed by a clearing house, making it possible for parties to trade with reduced counterparty risks.

Although primitive forms of futures markets were created in Europe during the 17th century, the Dōjima Rice Exchange (Japan) is regarded as the first futures exchange to be established. In early 18th-century Japan, most payments were made in rice, so futures contracts started to be used as a way to hedge against the risks associated with unstable rice prices.

With the emergence of electronic trading systems, the popularity of futures contracts, along with a range of use-cases, became widespread across the entire financial industry.

Functions of futures contracts

Within the financial industry context, futures contracts typically serve some of the following functions:

Hedging and risk management: futures contracts can be utilized to mitigate against a specific risk. For example, a farmer may sell futures contracts for their products to ensure they get a certain price in the future, despite unfavorable events and market fluctuations. Or a Japanese investor that owns US Treasury bonds may buy JPYUSD futures contracts for the amount equal to the quarterly coupon payment (interest rates) as a way to lock the value of the coupon in JPY at a predefined rate and, thus, hedging his USD exposure.

Leverage: futures contracts allow investors to create leveraged positions. As contracts are settled at the expiration date, investors are able to leverage their position. For example, a 3:1 leverage allows traders to enter into a position three times larger than their trading account balance.

Short exposure: futures contracts allow investors to take a short exposure to an asset. When an investor decides to sell futures contracts without owning the underlying asset, it is commonly referred to as a “naked position”.

Asset variety: investors are able to take exposure to assets that are difficult to be traded on the spot. Commodities such as oil are typically costly to deliver and involve high storage expenses, but through the use of futures contracts, investors and traders can speculate on a wider variety of asset classes without having to physically trade them.

Price discovery: futures markets are a one-stop-shop for sellers and buyers (i.e. supply and demand meet) for several asset classes, such as commodities. For example, the price of oil can be determined in relation to real-time demand on futures markets rather than through local interaction at a gas station.

Settlement mechanisms

The expiration date of a futures contract is the last day of trading activities for that particular contract. After that, trading is halted and the contracts are settled. There are two main mechanisms for futures contracts settlement:

Physical settlement: the underlying asset is exchanged between the two parties that agreed on a contract at a predefined price. The party that was short (sold) has the obligation to deliver the asset to the party that was long (bought).

Cash settlement: the underlying asset is not exchanged directly. Instead, one party pays the other an amount that reflects the current asset value. One typical example of a cash-settled futures contract is an oil futures contract, where cash is exchanged rather than oil barrels as it would be fairly complicated to physically trade thousands of barrels.

Cash-settled futures contracts are more convenient and, therefore, more popular than physical-settled contracts, even for liquid financial securities or fixed-income instruments whose ownership can be transferred fairly quickly (at least comparing to physical assets like barrels of oil).

However, cash-settled futures contracts may lead to manipulation of the underlying asset price. This type of market manipulation is commonly referred to as “banging the close” - which is a term that describes abnormal trading activities that intentionally disrupt orders books when the futures contracts are getting close to their expiration date.

Exit strategies for futures contracts

After taking a futures contract position, there are three main actions that futures traders can perform:Offsetting: refers to the act of closing a futures contract position by creating an opposite transaction of the same value. So, if a trader is short 50 futures contracts, they can open a long position of equal size, neutralizing their initial position. The offsetting strategy allows traders to realize their profits or losses prior to the settlement date.

Rollover: occurs when a trader decides to open a new futures contract position after offsetting their initial one, essentially extending the expiration date. For instance, if a trader is long on 30 futures contracts that expire in the first week January, but they want to prolong their position for six months, they can offset the initial position and open a new one of the same size, with the expiration date set to the first week of July.

Settlement: if a futures trader does not offset or rollover their position, the contract will be settled at the expiration date. At this point, the involved parties are legally obligated to exchange their assets (or cash) according to their position.

Futures contracts price patterns: contango and normal backwardation

From the moment futures contracts are created until their settlement, the contracts market price will be constantly changing as a response to buying and selling forces.

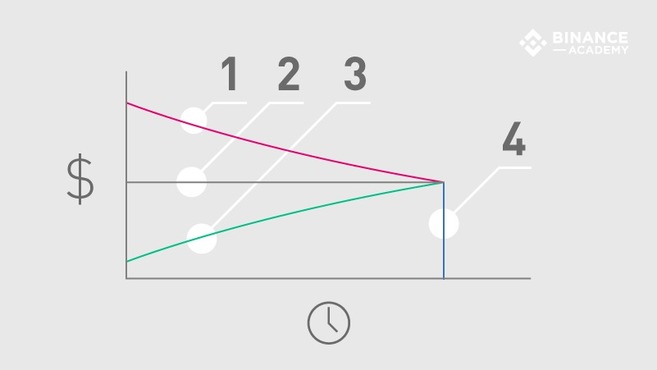

The relation between the maturity and varying prices of the futures contracts generate different price patterns, which are commonly referred to as contango (1) and normal backwardation (3). These price patterns are directly related to the expected spot price (2) of an asset at the expiration date (4), as illustrated below.

- Contango (1): a market condition where the price of a futures contract is higher than the expected future spot price.

- Expected spot price (2): anticipated asset price at the moment of settlement (expiration date). Note that the expected spot price is not always constant, i.e., it may change in response to market supply and demand.

- Normal backwardation (3): a market condition where the price of futures contracts is lower than the expected future spot price.

- Expiration date (4): the last day of trading activities for a particular futures contract, before settlement occurs.

While contango market conditions tend to be more favorable for sellers (short positions) than buyers (long positions), normal backwardation markets are usually more beneficial for buyers.

As it gets closer to the expiration date, the futures contract price is expected to gradually converge to the spot price until they eventually have the same value. If the futures contract and spot price are not the same at the expiration date, traders will be able to make quick profits from arbitrage opportunities.

In a contango scenario, futures contracts are traded above the expected spot price, usually for convenience reasons. For instance, a futures trader may decide to pay a premium for physical commodities that will be delivered in a future date, so they don’t need to worry about paying for expenses such as storage and insurance (gold is a popular example). Additionally, companies may use futures contracts to lock their future expenses on predictable values, buying commodities that are indispensable for their service (e.g., bread producer buying wheat futures contracts).

On the other hand, a normal backwardation market takes place when futures contracts are traded below the expected spot price. Speculators buy futures contracts hoping to make a profit if the price goes up as expected. For example, a futures trader may buy oil barrels contracts for $30 each today, while the expected spot price is $45 for the next year.

Closing thoughts

As a standardized type of forward contract, futures contracts are among the most used tools within the financial industry and their various functionalities make them suitable for a wide range of use cases. Still, it is important to have a good understanding of the underlying mechanisms of futures contracts and their particular markets before investing funds.While “locking” an asset’s price in the future is useful in certain circumstances, it is not always safe - especially when the contracts are traded on margin. Therefore, risk management strategies are often employed to mitigate the inevitable risks associated with futures contracts trading. Some speculators also use technical analysis indicators along with fundamental analysis methods as a way to get insights into the price action of futures markets.