Binance Totorials, What Is a Limit Order?

A limit order is an order that you place on the order book with a specific limit price. The limit price is determined by you. So when you place a limit order, the trade will only be executed if the market price reaches your limit price (or better). Therefore, you may use limit orders to buy at a lower price or to sell at a higher price than the current market price.

Unlike market orders, where trades are executed instantly at the current market price, limit orders are placed on the order book and are not executed immediately, meaning that you save on fees as a market maker.

How to use it?

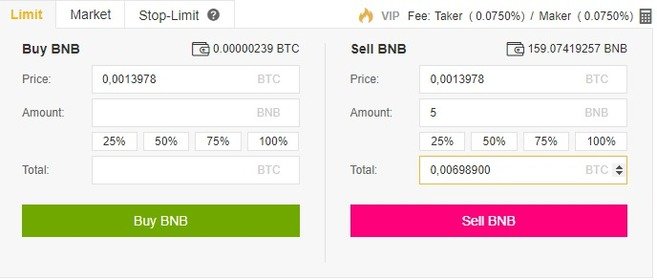

Let’s say you want to sell BNB at a higher price than what is currently being bid. After logging in to your Binance account, choose the BNB market you want (e.g., BNB/BTC) and go to the trading page. Then, find the Limit order tab, set the price and amount, and click the Sell BNB button. You may also set the amount by clicking the percentage buttons, so you can easily place a limit sell order for 25%, 50%, 75% or 100% of your balance.

After that, you will see a confirmation message on the screen, and your limit order will be placed on the order book, with a small yellow arrow.

You can scroll down to see and manage your open orders. The limit order will only execute if the market price reaches your limit price. If the market price doesn’t reach the price you set, the limit order will remain open.

When should you use it?

You should use limit orders when you are not in a rush to buy or sell. Unlike market orders, the limit orders are not executed instantly, so you need to wait until your ask/bid price is reached. Limit orders allow you to get better selling and buying prices and they are usually placed on major support and resistance levels. You may also split your buy/sell order into many smaller limit orders, so you get a cost average effect.