What is a Stop-Limit Order?

A stop-limit order is one of the many order types you will find on Binance. However, before proceeding with this one, we recommend you to first learn about limit and market orders.

The best way to understand a stop-limit order is to break it down into stop price and limit price. The stop price is simply the price that triggers a limit order, and the limit price is the specific price of the limit order that was triggered. This means that once your stop price has been reached, your limit order will be immediately placed on the order book.

Although the stop and limit prices can be the same, this is not a requirement. In fact, it would be safer for you to set the stop price (trigger price) a bit higher than the limit price (for sell orders) or a bit lower than the limit price (for buy orders). This increases the chances of your limit order getting filled after the stop-limit is triggered.

How to use it?

Let’s say you just bought 5 BNB at 0.0012761 BTC because you believe the price is close to a major support level and will likely go up from here.

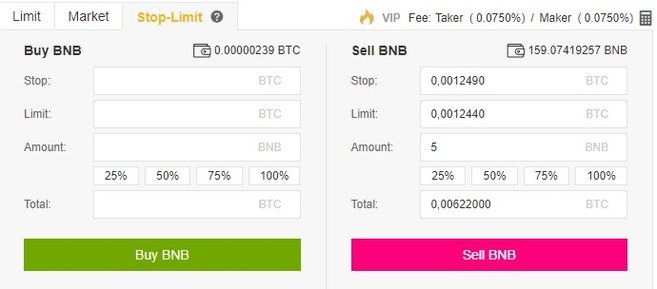

In this situation, you may want to set a stop-limit sell order to alleviate your losses in case your assumption is wrong, and the price starts to drop. To do that, log in to your Binance account and go to the BNB/BTC market. Then click on the Stop-Limit tab and set the stop and limit price, along with the amount of BNB to be sold.

So if you believe that 0.0012700 BTC is a reliable support level, you may set a stop-limit order just below this price (in case it doesn’t hold). In this example, we will set a stop-limit order for 5 BNB with the stop price at 0.0012490 BTC and the limit price at 0.0012440 BTC.

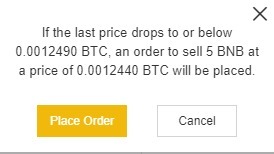

When you click Sell BNB, a confirmation window will appear. Make sure everything is correct and press Place Order to confirm.

After placing your stop-limit order, you will see a confirmation message.

You can scroll down to see and manage your open orders.

Note that the stop-limit order will only be placed if and when the stop price is reached, and the limit order will only be filled if the market price reaches your limit price. If your limit-order is triggered (by the stop price), but the market price doesn’t reach the price you set, the limit order will remain open.

Sometimes you might be in a situation where the price drops too fast, and your stop-limit order is passed over without being filled. In this case, you may appeal to market orders to quickly get out of the trade.

When should you use it?

Stop-limit orders are valuable as a risk management tool, and you should use it to avoid significant losses. Noteworthy, they are also useful for placing Sell orders to ensure that you take your profits when your trading targets are reached. You may also set a stop-limit buy order to buy an asset after a certain resistance level is breached during the start of an uptrend.